Make your home warmer with internal wall insulation and reduce your energy bills!

Contact us today to see if you qualify

(it takes less than 60 seconds)

Why should I have solid wall insulation?

How is it free?

Before

During

After

What are the benefits of Internal Wall Insulation (IWI)?

Solid wall properties made from solid stone or brick are excellent candidates for this type of insulation. By providing an additional layer of protection between the interior and external walls, internal wall insulation helps reduce heat transfer from outside temperatures into a property’s interior environment throughout all seasons of the year.

Insulation is applied to the inside face of external walls and a vapour barrier installed to protect against moisture penetration which can cause dampness and mould growth if left unchecked. Properly installed internal wall insulation can provide improved air quality and better living conditions for occupants over time.

Internal wall insulation can help significantly reduce heating costs during colder months while also keeping the property cooler during warmer months.

Save..

Help..

Protect..

Increase..

How much can you save with wall insulation?

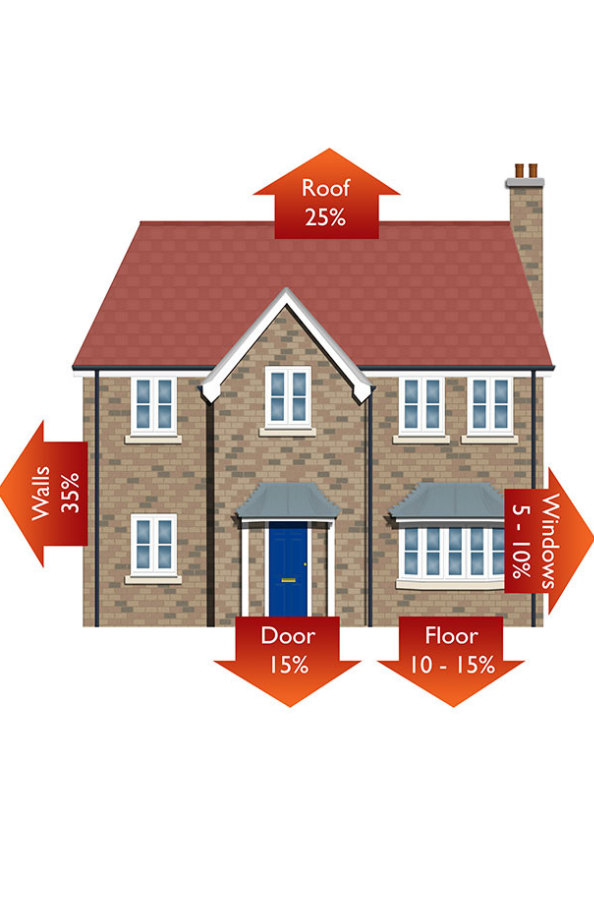

On average, around a third of the heat lost from uninsulated homes escapes through the external walls.

Most homes built before the 1920s have solid brick walls, which have very poor insulating qualities. That accounts for 8.5 million homes in Great Britain, and more than 90% of those are uninsulated.

If your home has solid walls, you could save £180-660 a year by installing solid wall insulation. Advice on insulating your solid walls – Energy Saving Trust

Frequently Asked Questions

Most frequent questions and answers

To qualify for the ECO4 scheme, at least one person living at the property has to be in receipt of, or have received within the past 6 months, one of the benefits listed below:

1) Income based Jobseekers Allowance (JSA)

2) Income related Employment and Support Allowance (ESA)

3) Income Support (IS)

4) Pension Credit Guarantee Credit (PCGC)

5) Working Tax Credit (WTC)

6) Child Tax Credit (CTC)

7) Universal Credit (UC)

8) Housing Benefit

9) Pension Credit Savings Credit (PCSC)

10) Child Benefit (subject to income caps and composition